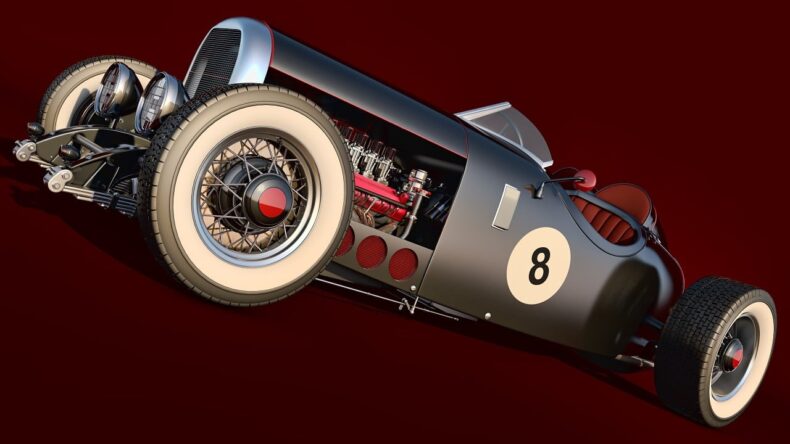

Are you the proud owner of a classic or bespoke vehicle? If so, you understand the unique joy and satisfaction that comes from driving a one-of-a-kind machine. However, with such a valuable asset, it’s crucial to protect it with the right insurance coverage. That’s where we come in. Our team specializes in providing insurance solutions tailored specifically for classic and bespoke vehicles.

We understand that these types of cars require a different level of attention and care, which is why our policies are designed to meet the unique needs of this niche market. From vintage sports cars to custom-built masterpieces, our comprehensive coverage options ensure that your investment is protected against theft, damage, and accidents.

With our expertise and commitment to exceptional customer service, you can have peace of mind knowing that your classic or bespoke vehicle is in safe hands. Vehicles like the one at ECD Automotive Design which are both bespoke and a classic can be difficult to find the right insurance for. Don’t settle for standard insurance when you can have the best. Contact us today to discuss your insurance needs and let us help you preserve the beauty and value of your prized possession.

What is classic and bespoke vehicle insurance?

Classic and bespoke vehicle insurance is a specialized type of coverage specifically designed to protect vintage, rare, and custom-built cars. These vehicles are not your everyday cars, and their value goes beyond their price tag. Classic cars are usually older vehicles that are considered to be of historical interest, while bespoke vehicles are custom-made and unique creations.

Due to their rarity and uniqueness, these vehicles require specialized insurance coverage that takes into account their value, the cost of repairs, and the level of care they require. Classic and bespoke vehicle insurance provides comprehensive protection against theft, damage, accidents, and other risks that these vehicles may face.

When it comes to insuring classic and bespoke vehicles, it’s essential to work with insurance providers who understand the specific needs of this niche market. Standard insurance policies may not provide adequate coverage for these unique vehicles, and in the event of a claim, you may find yourself underinsured. That’s why it’s crucial to seek out insurance companies that specialize in classic and bespoke vehicle insurance. These companies have the expertise and knowledge to create policies that offer the right level of protection for your prized possession, ensuring that you’re adequately covered in case of any unforeseen circumstances.

The importance of insurance for classic and bespoke vehicles

Source: scribd.com

Owning a classic or bespoke vehicle is a significant investment, both financially and emotionally. These vehicles often hold sentimental value and can be a source of pride for their owners. However, they also come with their fair share of risks. Whether it’s a rare vintage car or a custom-built masterpiece, these vehicles are more susceptible to theft, damage, and accidents. Without the right insurance coverage, you could be left with a substantial financial burden in the event of an unfortunate incident.

Insurance for classic and bespoke vehicles provides peace of mind by offering financial protection against a range of risks. In the event of theft, your insurance policy will cover the cost of replacing the vehicle, ensuring that you’re not left empty-handed. Similarly, if your vehicle is damaged in an accident, your insurance will cover the cost of repairs, ensuring that your cherished vehicle can be restored to its former glory. Additionally, insurance coverage provides liability protection, safeguarding you against potential lawsuits in case of accidents that cause injury or property damage to others.

Having the right insurance coverage for your classic or bespoke vehicle is not just about protecting your investment; it’s also about protecting your passion. These vehicles are often a labor of love, and their owners take great pride in their ownership. By having the right insurance policy in place, you can drive with confidence, knowing that you’re covered for any unforeseen circumstances that may arise. It’s a way to ensure that your beloved vehicle remains a source of joy and pride for years to come.

Types of coverage for classic and bespoke vehicles

When it comes to insuring classic and bespoke vehicles, there are several types of coverage options to consider. Each type of coverage offers a specific level of protection, and it’s important to choose the right combination of coverages that best meets your needs. Here are some of the most common types of coverage for classic and bespoke vehicles:

1. Agreed Value Coverage: Agreed value coverage is a type of insurance that ensures you will receive the full agreed-upon value of your vehicle in the event of a total loss. Unlike standard insurance policies that may only provide actual cash value, agreed value coverage takes into account the uniqueness and rarity of your vehicle. This means that if your vehicle is deemed a total loss, you will receive the full agreed value, regardless of depreciation.

2. Comprehensive Coverage: Comprehensive coverage provides protection against non-collision related risks, such as theft, vandalism, fire, and natural disasters. With comprehensive coverage, you can have peace of mind knowing that your vehicle is protected against a wide range of potential risks.

3. Collision Coverage: Collision coverage protects against damage to your vehicle resulting from a collision with another vehicle or object. This coverage ensures that you’re covered for repairs or replacement if your vehicle is damaged in an accident.

4. Liability Coverage: Liability coverage is essential for any vehicle owner, including classic and bespoke vehicle owners. This coverage protects you in case you’re at fault in an accident that causes injury or property damage to others. Liability coverage helps cover the costs of medical expenses, repairs, and legal fees associated with the accident.

5. Uninsured/Underinsured Motorist Coverage: Uninsured/underinsured motorist coverage protects you in the event of an accident caused by a driver who doesn’t have insurance or doesn’t have enough insurance to cover the damages. This coverage ensures that you’re not left with the financial burden of repairs or medical expenses if you’re involved in an accident with an uninsured or underinsured driver.

Choosing the right combination of coverages for your classic or bespoke vehicle is crucial. It’s important to carefully evaluate your needs and the value of your vehicle to determine the appropriate level of coverage. Working with an insurance provider who specializes in classic and bespoke vehicle insurance can help guide you through the process and ensure that you have the right coverage in place.

Factors that affect classic and bespoke vehicle insurance rates

Source: lvbroker.co.uk

When it comes to determining insurance rates for classic and bespoke vehicles, several factors come into play. Understanding these factors can help you better navigate the insurance landscape and find the best coverage at the most competitive rates. Here are some of the key factors that may affect classic and bespoke vehicle insurance rates:

6. Vehicle Value: The value of your vehicle is a significant factor that insurance companies consider when determining rates. Classic and bespoke vehicles often have higher values than standard cars, which means that the insurance premiums may be higher as well. The rarer and more valuable your vehicle is, the more you can expect to pay for insurance coverage.

7. Vehicle Age: The age of your vehicle can also impact insurance rates. Classic cars, by definition, are older vehicles, and their age can affect their insurability. Older cars may require more maintenance and repairs, which can increase the risk for insurance companies and subsequently impact the rates.

8. Vehicle Usage: How you use your classic or bespoke vehicle can also affect insurance rates. Some insurance companies offer different rates based on whether the vehicle is used for pleasure driving, exhibitions, or regular commuting. The more you use your vehicle, the higher the risk, and the higher the insurance rates may be.

9. Driving Record: Your driving record plays a significant role in determining insurance rates for any vehicle, including classic and bespoke vehicles. Insurance companies consider your history of accidents, traffic violations, and claims when calculating premiums. A clean driving record can help lower your insurance rates, while a history of accidents or violations may result in higher rates.

10. Storage and Security: How you store and secure your classic or bespoke vehicle can also affect insurance rates. Insurance companies often offer lower rates if your vehicle is stored in a secure garage, equipped with an alarm system, or if you use additional security measures such as steering wheel locks or GPS tracking devices.

11. Location: The location where your vehicle is primarily kept can impact insurance rates. Some areas may have higher rates of theft or vandalism, which can result in higher premiums. Similarly, if you live in an area with a higher risk of natural disasters, such as hurricanes or earthquakes, insurance rates may be higher to reflect the increased risk.

12. Driving Experience: Your driving experience and age can also affect insurance rates. Younger drivers or drivers with less experience may face higher insurance premiums due to the increased risk associated with their age group. Insurance companies often offer discounts for drivers with a clean driving record and several years of driving experience.

When shopping for insurance for your classic or bespoke vehicle, it’s important to consider these factors and provide accurate information to insurance providers. This will help ensure that you receive accurate quotes and that you find the best coverage at the most competitive rates.

Tips for finding the right insurance provider for classic and bespoke vehicles

Source: mkiins.com

Finding the right insurance provider for your classic or bespoke vehicle is essential to ensure that you have the coverage you need at a price that fits your budget. With so many insurance companies out there, it can be overwhelming to navigate the landscape and choose the right provider. Here are some tips to help you find the right insurance provider for your classic or bespoke vehicle:

13. Research and compare: Take the time to research different insurance providers that specialize in classic and bespoke vehicle insurance. Look for companies with a track record of serving this niche market and read reviews or testimonials from other classic car owners. Compare quotes and coverage options from multiple providers to get a sense of the market rates and offerings.

14. Seek recommendations: Reach out to other classic or bespoke vehicle owners and ask for their recommendations. Word-of-mouth referrals can be a valuable source of information and can help you find insurance providers that have a reputation for excellent service and coverage.

15. Check for specialized coverage: Ensure that the insurance provider offers specialized coverage for classic and bespoke vehicles. Standard insurance policies may not provide adequate coverage for these unique vehicles, so it’s crucial to work with providers who understand the specific needs of this niche market.

16. Evaluate customer service: Look for insurance providers that offer exceptional customer service. Dealing with insurance claims can be stressful, and you want to work with a provider that is responsive, helpful, and supportive throughout the process. Read reviews or ask for references to get a sense of the provider’s customer service track record.

17. Consider policy flexibility: Classic and bespoke vehicle owners often have unique needs when it comes to insurance coverage. Look for providers that offer flexible policy options, allowing you to tailor the coverage to your specific requirements. This can include options for agreed value coverage, coverage for modifications, and options for storing or displaying your vehicle at exhibitions or shows.

18. Review policy terms and conditions: Carefully review the terms and conditions of the insurance policies you are considering. Pay attention to any exclusions or limitations that may impact your coverage. It’s important to have a clear understanding of what is covered and what is not to avoid any surprises in the event of a claim.

19. Ask about discounts: Inquire about any available discounts that may help reduce your insurance premiums. Some insurance providers offer discounts for factors such as low mileage, multiple policies, or membership in classic car clubs or associations. Taking advantage of these discounts can help you save on your insurance premiums.

By following these tips, you can streamline your search for the right insurance provider and ensure that you have the coverage you need for your classic or bespoke vehicle.

Common misconceptions about classic and bespoke vehicle insurance

Source: ranchosimiinsurance.com

When it comes to insuring classic and bespoke vehicles, there are several misconceptions that can lead to confusion or misunderstandings. It’s important to separate fact from fiction to make informed decisions about your insurance coverage. Here are some common misconceptions about classic and bespoke vehicle insurance:

20. Standard insurance is sufficient: One of the most common misconceptions is that standard insurance policies provide adequate coverage for classic and bespoke vehicles. However, standard policies may not take into account the unique value and needs of these vehicles. Specialized insurance is designed to protect these assets more comprehensively.

21. Classic cars are always expensive to insure: While it’s true that classic cars can have higher insurance premiums due to their value, it’s not always the case. Insurance rates depend on various factors, such as the vehicle’s age, usage, and your driving record. By shopping around and comparing quotes, you may find affordable insurance options for your classic car.

22. Agreed value coverage is unnecessary: Some classic car owners may not see the need for agreed value coverage, assuming that actual cash value coverage is sufficient. However, actual cash value coverage may not fully cover the true value of your classic car in the event of a total loss. Agreed value coverage ensures that you receive the full agreed-upon value, regardless of depreciation.

23. Classic car insurance is only for show cars: Another misconception is that classic car insurance is only for vehicles that are used exclusively for exhibitions or shows. While some policies offer coverage for these specific uses, classic car insurance is available for vehicles that are driven regularly as well. It’s important to choose a policy that aligns with your vehicle’s usage.

24. Classic car insurance is too complicated: Some owners may shy away from classic car insurance, thinking that it’s too complex or difficult to navigate. While classic car insurance has its unique considerations, working with an insurance provider that specializes in this type of coverage can simplify the process. These providers have the expertise to guide you through the options and ensure that you have the right coverage in place.

By understanding these misconceptions, you can make more informed decisions when it comes to insuring your classic or bespoke vehicle. Always consult with insurance professionals who specialize in this niche market to ensure that you have the right coverage for your unique vehicle.

Steps to take in the event of an accident or damage to a classic or bespoke vehicle

No one likes to think about accidents or damage to their beloved classic or bespoke vehicle, but being prepared can make all the difference. In the event of an accident or damage, it’s important to take the right steps to ensure a smooth claims process and minimize any further damage. Here are the steps to take in the event of an accident or damage to your classic or bespoke vehicle:

25. Ensure safety: If you’re involved in an accident, prioritize safety above all else. If it’s safe to do so, move your vehicle to a safe location away from traffic. Check yourself and any passengers for injuries and call emergency services if necessary. If you’re unable to move your vehicle, turn on the hazard lights to alert other drivers